Returns differ across market cap/time

We all know an ideal team is required for a match-winning performance, and for an ideal team, a captain has to pick the right mix of batsmen and bowlers based on the pitch conditions. The same holds true for your investment portfolio too. It should have the right mix of Large, Mid, and Small-cap stocks based on the market conditions as the returns differ across market caps and time.

The Fund is a Triveni Sangam Of Large, Mid And Small-Cap Stocks

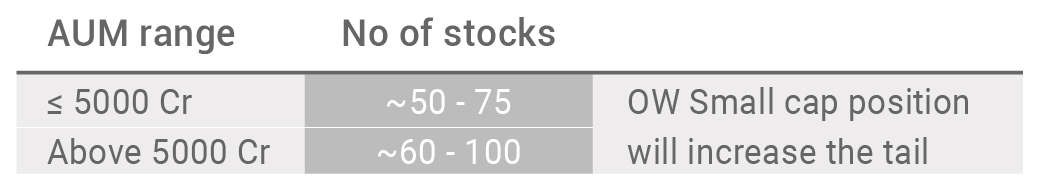

The fund will have a minimum 25% allocation in the large, mid, and small-cap stocks each for maximum benefit. The balance 25% will be dynamically allocated by taking the help of our proprietary model.

How do we decide to go overweight on a particulate market cap?

Our propitiatory model guides us on which market to be overweight. It is based on 2 primary factors i.e. Mean reversion – which suggests when exactly to go overweight in a particular market cap. And, Momentum – which will essentially suggest the duration of the overweight position.

Stock selection has the ability to enhance returns potential further

Who can invest?

This fund is suitable for everyone who has a long term financial goal such as -

No comments:

Post a Comment